Pricing Subscription Products with a Data-Driven Conscience

Using data to drive pricing a SaaS product

At Square, Product Analytics is embedded within full-stack product teams, which allows each of us to become a data expert for our respective products. Our high-visibility position(s) within each product allows us to drive the decision-making process with the entire analytics toolkit: consulting, plumbing, analysis, science and evangelism. Here follows a canonical example: pricing products judiciously and optimally.

Background

The first incarnation of Square Loyalty, which enabled Square sellers to offer digital rewards programs (e.g. digitized punch cards) to their customers, was released in 2013. This post details the data-driven steps we took to provide our sellers a fairly-priced, high-value product that can help them run and grow their businesses.

Product Lifecycle: From Free to Paid

When launching a product, our main goal at the outset is to drive adoption. With this in mind, we launched Square Loyalty in 2013 with very basic features (a.k.a. minimum viable product or MVP) at no cost to our sellers to encourage everyone to try it. We tracked Square Loyalty’s metrics around how many sellers were using it (acquisition), how often (engagement) and for how many months/years (retention), and how much value they got from it (product-market fit).

As we iterated on and improved Square Loyalty, we saw our sellers gaining more value in their own businesses from using it, which increased seller engagement and retention. We knew we had a solid product — one that would benefit from having more resources (e.g., engineering and product management time) behind it to drive significant improvements for our sellers.

For example, by studying the data we logged and listening to customer feedback, we found, to our surprise, that Square Loyalty was* too* automated and thus easy to miss during the checkout experience. It was built into the bottom of receipts, but perhaps so smoothly that buyers were unaware that they had rewards to work toward and redeem. We owed it to our sellers to place a smarter, more useful tool into their point of sale. To that end, we doubled down and reimagined the product experience.

Loyalty v1: At the bottom of a digital receipt

Loyalty v1: At the bottom of a digital receipt

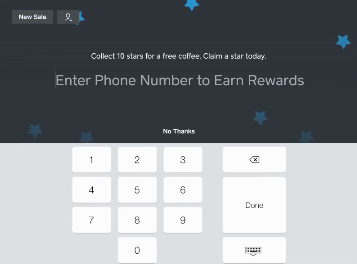

Loyalty v2: Enroll at the Point of Sale

Loyalty v2: Enroll at the Point of Sale

The result was the relaunch of Square Loyalty in June 2016. The rewards program was decoupled from receipts, increasing buyer awareness. Further, switching to a pure SMS-based system permitted a more seamless experience (provide your phone number instead of looking up your coupon code). Following up the SMS notifications with email-collection tools ensured existing sellers could continue to de-anonymize, identify, engage and reward their top customers.

At this point, we also knew that charging for this product could help us generate the revenue needed to support the work of building product features and addressing seller feedback. Why? Charging for a product increases overall happiness with the product if it means increased resources for marketing, product improvements, and most importantly, prioritizing and addressing customer feedback. But what was the best price for this product to ensure our sellers got the highest possible return on their investment?

Determining Price: Leveraging Square’s Unique Data

At Square, our suite of seller tools gives us unique access to what we call the “closed loop” of data on payments attribution: every transaction at a Square seller passes through our credit card readers or payment APIs, which enables us to determine the effectiveness of Square Loyalty digital rewards programs (and other marketing campaigns run by our Square sellers) in a very precise fashion. We can determine how many buyers return to a business because of the loyalty program versus those who would have come back anyway. With our closed loop, there are fewer proxies and less guessing, more knowing.

Methods and Results

Before determining how much to charge, we first had to assess and measure the incremental value that sellers get from a digital rewards program like Square Loyalty. The usual answer to everything — run an A/B test — was a non-starter because it would interfere with our sellers’ business and potentially create confusion. Instead, we got creative and defined a natural experiment to compare buyers who were aware of and redeemed their Square Loyalty rewards against buyers who were not aware of and did not redeem their rewards.

We defined awareness as:

-

If a buyer had redeemed a reward at any point with a particular seller, or opened a reward-notification or welcome email sent via Square on behalf of that seller, we can assume that buyer was aware of how Square Loyalty works.

-

If a buyer had earned a reward with a particular seller and actually returned later, but did not redeem their reward, we can assume that buyer was unaware of how Square Loyalty works.

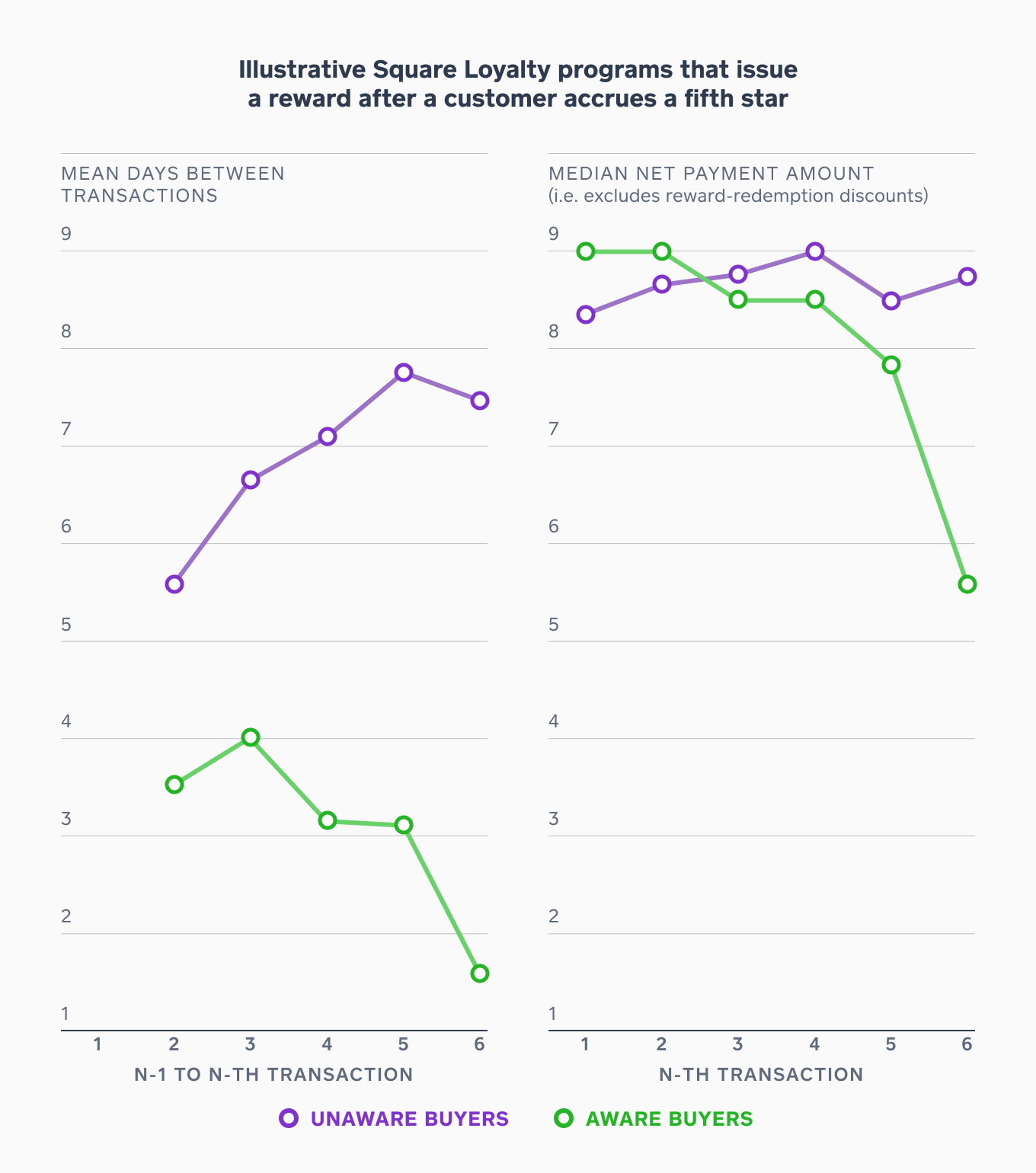

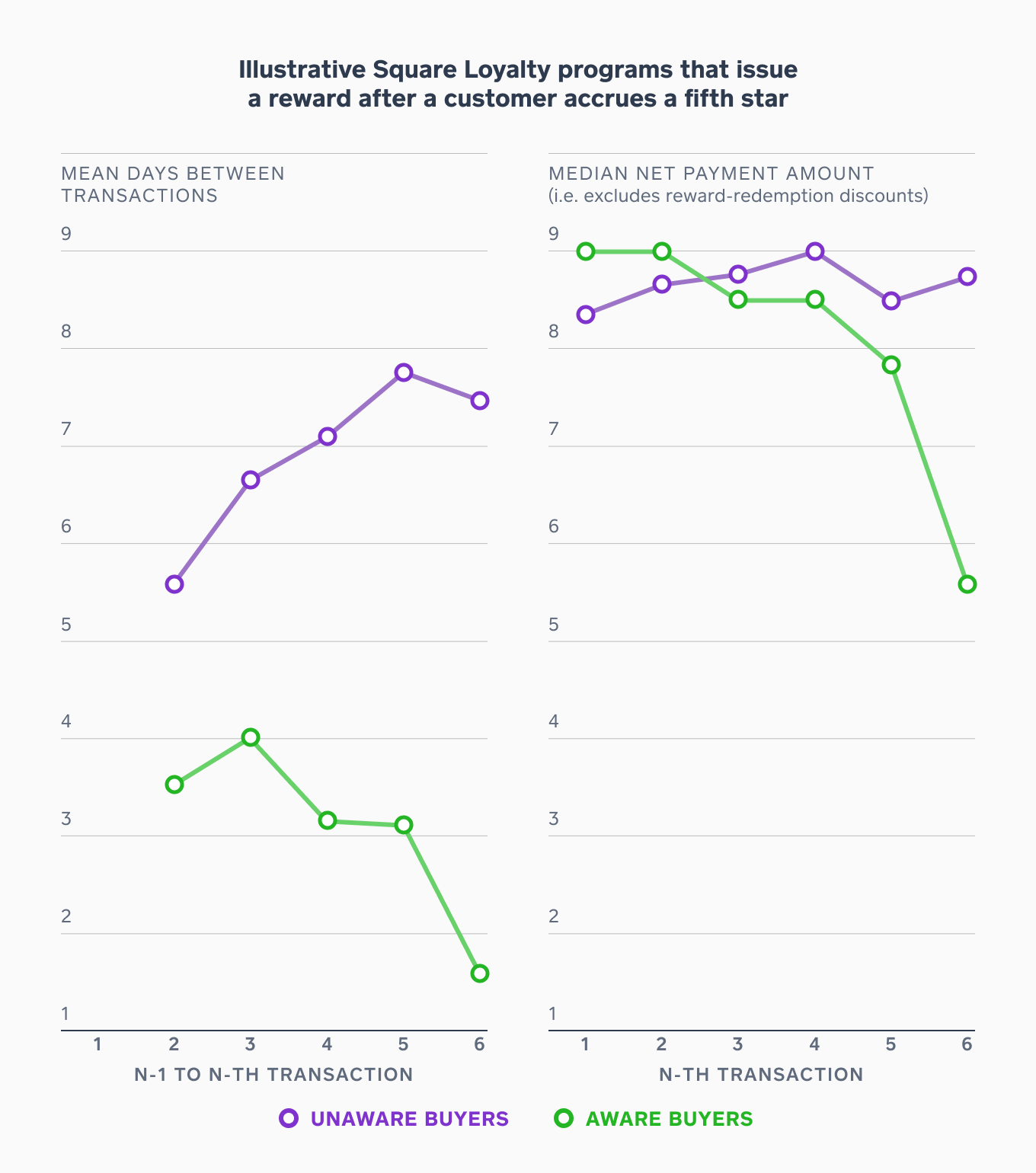

With that distinction made, it was simply a measurement of metrics for both buyer groups. Buyers who were ‘aware’ and enrolled in Square Loyalty returned at least twice as often as those who were ‘unaware.’ While there was a drop in payment amount due to the reward-redemption discount, the former effect of buyers coming back twice as often was much larger. Even before overhauling the product with major improvements, we could see this was already a seller tool worth paying for.

Aware buyers returned more frequently and paid less only when redeeming their reward.

Aware buyers returned more frequently and paid less only when redeeming their reward.

Another key assumption was deciding whether the incremental lift between the two buyer groups could be generalized to all buyers, all buyers enrolled in Square Loyalty, or all buyers who had earned a reward and returned. Since we know the answer lies somewhere in between, we simply tried all of them with best- and worst-case scenarios in mind. But putting that aside for now, we had used our closed loop and opportunistic operational intuition to prove the incremental value that Square Loyalty brings to our sellers.

Pricing Optimization

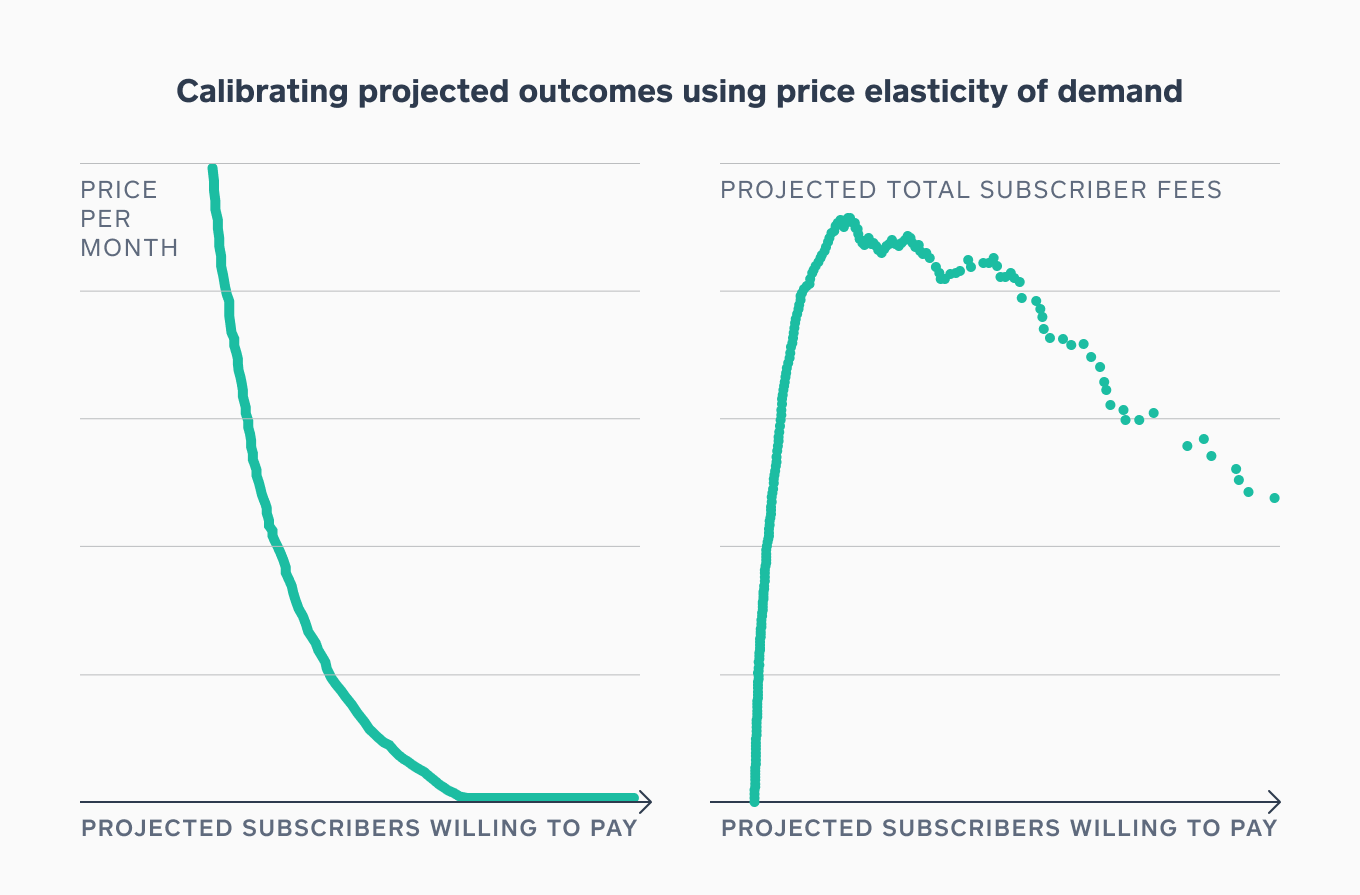

Now that we knew for sure that our sellers were getting a lot out of Square Loyalty, the next question was how much to charge. We used our closed loop to generate a ‘many-worlds’ interpretation of our potential price that mimics the retail context. Since we know the value our sellers derive from our products, we can assume that this is their marginal willingness to pay, minus assumptions about gross margin and perceptual differences. We could then construct a price-elasticity curve for our sellers that shows how increases in price result in fewer subscribers. This allowed us to calibrate the price against what we expected to receive in fees.

The revenue-maximizing price for Square was not the right answer because this is derived from the price elasticity for retention, which assumes that a seller can feel the value the same way we do and actually tries the product long enough to do so. Charging a high price, even if the product is worth that much, is a bad idea if it scares everybody from signing up in the first place. Nevertheless, it was a useful exercise in illustrating the ceiling and trade-offs available to us in making a decision as important and sensitive as pricing.

Conclusion

Pricing tests commenced in April 2016, and we were ready with our final decision on pricing by the time Square Loyalty was relaunched in June. The result has been overwhelmingly positive: Square Loyalty has one of the lowest churn rates we’ve seen, and our monitoring of the value sellers get out of the product (once again, through our closed loop) shows that value has increased monotonically since launch and our Square Loyalty subscribers get great ROI.

Are we done yet? Never. Pricing should never be considered a resolved issue. Our aim is always to give every seller a fair price that is equally commensurate with value, yet is still easily interpretable and transparent to all. Simultaneously, we stand behind the proven value of our product, and continue to ship improvements at a furious cadence. We have only tapped the surface of what is possible with Square Loyalty, and we hope you’ll join us for the ride.